-

·

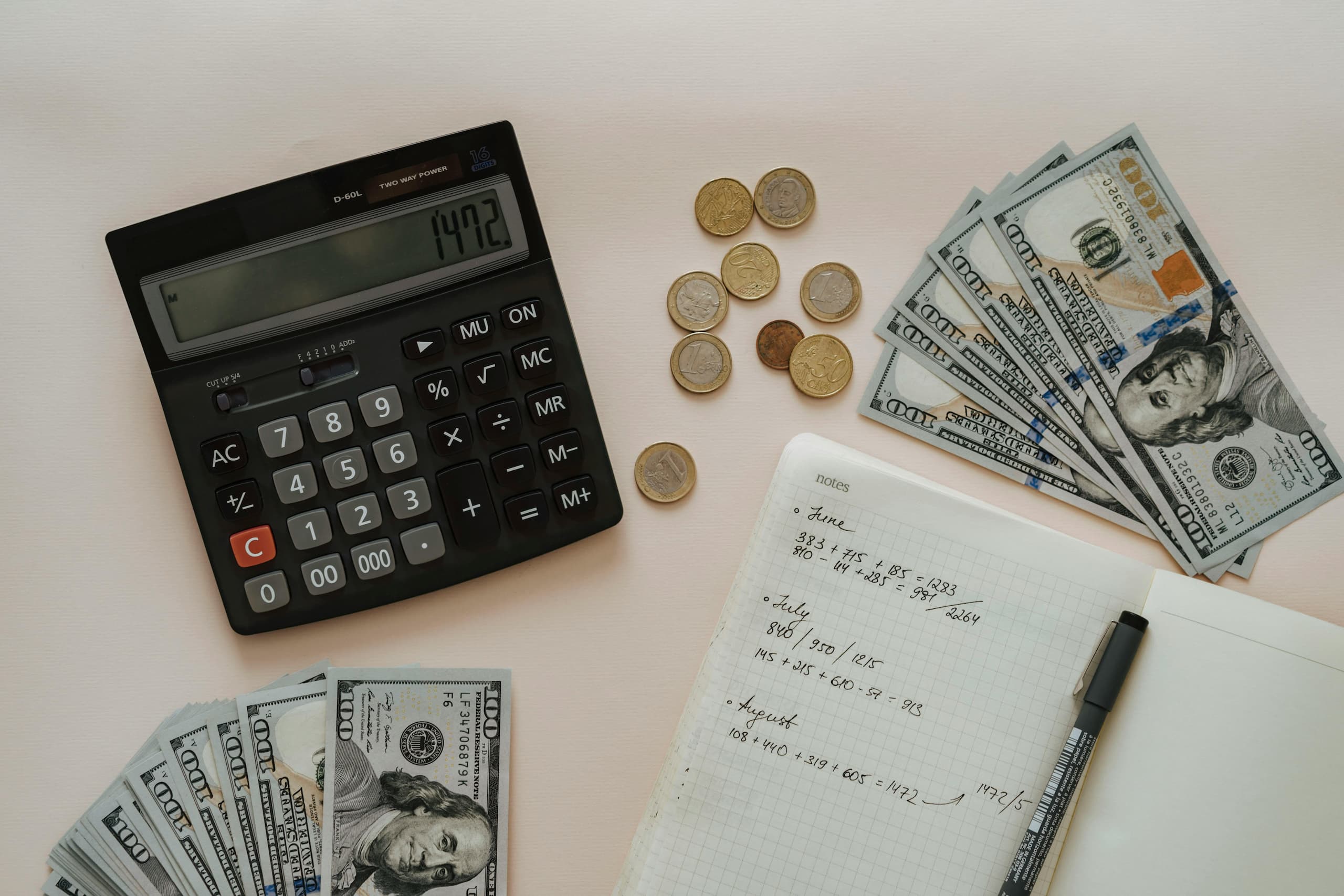

How to Achieve Financial Success: 7 Steps to Take Control of Your Money

What does financial success really mean? For some, it’s buying a home. For others, it’s living debt-free or retiring early. Whatever it looks like for you, achieve financial success with the right mindset, tools, and strategy. In this guide, we break down 7 key steps to achieving financial success no matter where you’re starting from.…

-

·

Why Credit Matters More Than You Think: How a Powerful 3-Digit Score Shapes Your Financial Life

If you’ve ever wondered why credit matters and why your credit score seems to follow you everywhere, you’re not alone. Credit might feel like an invisible force, but it plays a very real role in your financial life. Whether you’re applying for a loan, trying to rent an apartment, or even interviewing for a job,…

-

·

How to Stop Living Paycheck to Paycheck: A Realistic 5-Step Plan That Works

Living paycheck to paycheck can feel like running on a treadmill—you’re working hard but never getting ahead. Whether you earn $30k or $100k per year, the cycle of just barely making it to the next payday can be stressful and exhausting. The good news? You can break free from it. In this guide, you’ll learn…

-

·

Calculate Your Net Worth – It’s Easy (And Why It Matters More Than You Think)

When it comes to your personal finances, one number matters more than your salary, your savings balance, or even your monthly budget: your net worth. This single figure gives you a full-picture view of your financial health — and tracking it over time can be incredibly motivating. In this article, we’ll break down exactly how…

-

·

How to Build an Emergency Fund: Your Financial Safety Net

Imagine your car breaks down, you lose your job, or a surprise medical bill shows up. What happens next? If you have an emergency fund, you don’t panic—you stay in control with your financial safety net. In this guide, we’ll break down what an emergency fund is, why it’s crucial, how much you need, and…

-

·

How to Check Your Credit Score and Why It’s Important

Your credit score is one of the most important numbers in your financial life. It can affect your ability to rent an apartment, buy a home, get a loan, or even land a job. Despite its significance, many people don’t check their credit score regularly—or at all. In this article, we’ll explain how to check…

-

·

Budgeting Basics: How to Take Control of Your Money

Budgeting isn’t about restriction—it’s about freedom. When you know where your money goes, you can stop living paycheck to paycheck, start building savings, and move closer to your financial goals. Whether you want to get out of debt, save for a big purchase, or just stop feeling anxious about money, budgeting is your first step.Here’s…